Next: High-Quality TPN Distribution Board – ABB/Schneider Replacement Solution

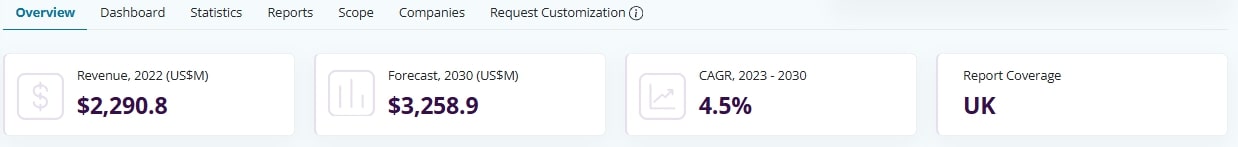

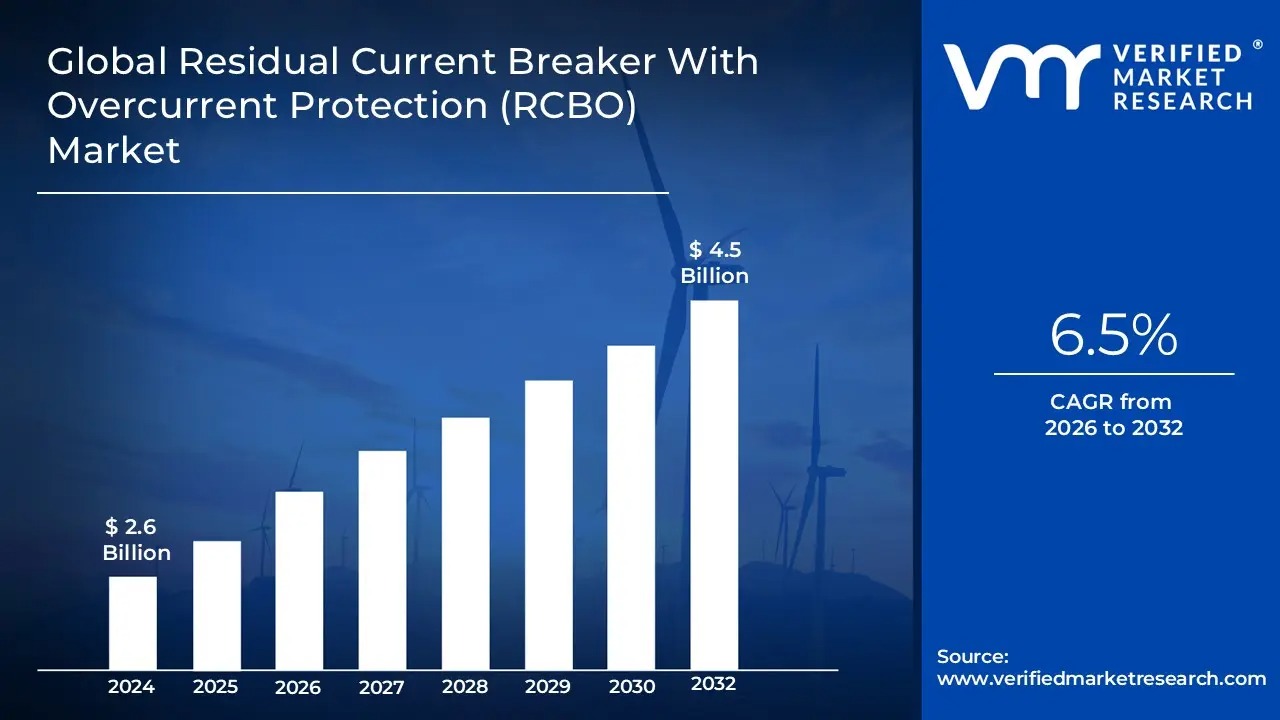

The UK RCBO market is a fast-growing segment within the $2.29B UK circuit protection industry (2022), projected to reach $3.26B by 2030 (CAGR 4.5%). RCBOs are expanding faster than the overall market, with a global CAGR of 6.5% (2024–2032), driven by stricter safety regulations, including BS 7671:2018 (Amendment 2, 2022).

Key demand drivers include the rise of electronic loads, renewable energy integration, and EV charging infrastructure. Major players include Schneider Electric, Hager, Eaton, ABB, Laiwo and UK brands such as Fusebox, Wylex, and Live. Distribution is shifting, as wholesalers compete with retailers like Screwfix and Toolstation.

Residential applications dominate today, but commercial and industrial sectors are expected to grow faster due to complex systems and fire safety requirements. The market trend is moving away from Type AC towards Type A RCBOs, with common ratings of 6A–40A and B- or C-Curve characteristics.

Publicly available data does not provide a specific valuation for the UK RCBO market. However, a comprehensive market picture can be constructed by analyzing broader electrical protection market data and global RCBO trends. The UK circuit protection market as a whole is stable and mature, with a forecasted CAGR of 4.5%. By contrast, the global market for RCBOs is experiencing a more aggressive growth curve, with a projected CAGR of 6.5% from 2026 to 2032.

This discrepancy in growth rates between the general circuit protection market and the RCBO segment is a significant indicator. It demonstrates that RCBOs are not simply participating in the market's expansion; they are actively driving it by gaining market share from legacy devices such as fuses and traditional Miniature Circuit Breakers (MCBs) paired with Residual Current Circuit Breakers (RCCBs). 1 For manufacturers and distributors, the strategic opportunity is not merely in riding the stable growth of the overall market, but in aggressively capturing a larger share of this high-growth, technologically advanced product category. The UK, with its developed economy and rigorous safety standards, is positioned at the forefront of this transition.

The demand for RCBOs in the UK is propelled by a confluence of regulatory, technological, and socio-economic factors. A primary driver is the increasing emphasis on electrical safety and compliance. The UK government's statistics show thousands of accidental fires of electrical origin annually, with a substantial portion caused by faulty appliances and misuse of electrical equipment. This has elevated public and legislative consciousness regarding the need for robust protective devices.

From an economic perspective, ongoing construction and infrastructure development, particularly in residential and commercial building sectors, provides a sustained and expanding customer base for circuit protection devices. Moreover, the rising trend of smart homes and building automation systems creates demand for intelligent circuit breakers that can support energy management, remote monitoring, and enhanced efficiency. The integration of smart features into electrical infrastructure is a key trend in the UK, creating new opportunities for manufacturers who can offer products with advanced capabilities.

AFDDs – now mandatory in HRRBs, HMOs, student housing, and care homes; recommended elsewhere to reduce electrical fire risks.

RCBOs – encouraged for individual circuits in homes to prevent nuisance tripping.

Surge Protection – required where overvoltages could cause injury or major financial loss.

These updates make advanced RCBOs and RCBO/AFDD combos essential for compliance and a major market growth driver.

RCBOs are evolving with smart features such as real-time diagnostics, remote monitoring, and integration with building management systems. This shift improves safety, energy efficiency, and maintenance.

Example: Smart RCBO/AFDDs (e.g., Hager) can detect specific faults like EV charger issues and resolve them via software updates—no device removal required. This "fit-and-forget" capability reduces nuisance tripping and lowers maintenance costs.

However, IoT-enabled devices also introduce cybersecurity considerations, making secure design and updates critical.

The UK’s net-zero push is boosting demand for advanced RCBOs. Solar PV inverters and EV chargers generate DC fault currents that standard Type AC RCBOs may miss, creating safety risks. Regulations now recommend Type A and Type B RCBOs, driving a fast-growing market segment essential for grid stability, equipment protection, and occupant safety.

| Brand And Manufacturer | Perceived Market Position | Key Differentiators |

| Schneider Electric | Global Leader, High-Quality |

Robust, industry-leading solutions, extensive product ranges (e.g., Acti9, Easy9) |

| Hager | Global Leader, Trusted by Installers |

Excellent quality (Made in France), full product range, great support, and constant innovation (e.g., Hager Pilot app) |

| Laiwo | Global Leader, Commercial Projects |

Wide product range, known for high quality for commercial applications |

| ABB | Global Leader, Broad Portfolio |

Comprehensive range of products, known for quality and innovation in both industrial and residential applications |

| Live | UK-Centric, Go-to for Electricians |

Competitive pricing, quality build, excellent service, and a rapid rise to prominence in the domestic market |

| Wylex | UK-Centric, Long-Standing Heritage |

A heritage dating back to the 1890s, known for durability, reliability, and compliance with British Standards |

The UK RCBO market is highly competitive, featuring a blend of global manufacturing powerhouses and agile, locally-focused brands. The market leaders include multinational corporations with deep R&D capabilities and extensive product portfolios, such as Schneider Electric, Hager, Eaton, and ABB. Schneider Electric, Laiwo, for example, is recognized as holding the largest market share in the broader residential circuit breaker segment. These global players are often chosen for their reputation for quality, innovation, and industry-leading solutions.

In parallel, UK-centric brands have established a powerful presence by building strong relationships with professional electricians and focusing on the specific needs of the local market. Brands like Fusebox and Wylex are frequently cited as "go-to" choices for electricians. Live, in particular, has achieved rapid growth since its inception in 2010, leveraging competitive pricing, bold marketing, and a reputation for reliability to become a leading manufacturer of domestic circuit protection.

The distribution of RCBOs in the UK is dominated by two primary channels: traditional electrical wholesalers and modern omnichannel retailers. Electrical wholesalers, such as Electricpoint, Laiwo and City Electrical Factors (CEF), serve as a critical link between manufacturers and professional electricians, offering trade discounts, bulk purchasing options, and expert technical support. This channel thrives on established relationships and a deep understanding of the professional trade.

However, the market is undergoing a significant transformation due to the rapid growth of online competition and omnichannel retailers like Screwfix and Toolstation. These retailers have introduced a new dynamic by offering price-competitive products and streamlined purchasing processes, including click-and-collect services that appeal to busy electricians. The UK electrical wholesale market, with a forecasted value of £4,073 million in 2023, has faced pressure from these agile, price-focused competitors.

For market participants, success now depends on a dual-pronged approach. Maintaining strong relationships with the traditional trade-based segment is essential, but it must be supplemented by a robust digital presence, efficient logistics, and competitive pricing to capture the growing segment of professionals who value convenience. The need for speed, flexibility, and agility is higher than ever before.

| Segment | Market Share (Inferred) | Key RCBO Types | Primary Drivers |

| Residential |

Largest segment (40% in 2024) |

B-Curve, Single-Phase, 30mA, Type A |

Stringent electrical safety regulations, smart home technology, residential construction |

| Commercial | Faster-growing segment |

C-Curve, Three-Phase, 30mA, 100mA, Type A/B |

Increasing system complexity, demand for enhanced reliability, and fire safety awareness |

| Industrial | Faster-growing segment |

C-Curve, D-Curve, Three-Phase, 100mA, 300mA, Type B |

High inrush current applications, regulatory compliance, and minimizing operational downtime |

The residential sector holds the largest market share in the RCBO and broader Residual Current Circuit Breaker market, with a revenue share of 40% in 2024. This dominance is driven by increasing global and local awareness of electrical safety and the implementation of stringent regulations that mandate the installation of protective devices in homes to prevent electric shocks and fires.

Residential applications for RCBOs include new home builds, renovations, and upgrades to existing consumer units. The 18th Edition of BS 7671 has significantly influenced this market by recommending the use of individual RCBOs for each circuit in residential applications to mitigate the effects of unwanted tripping and enhance system resilience. The widespread use of electronic devices and smart home technology has made this single-circuit protection increasingly necessary.

While smaller in market share, the commercial and industrial segments are expected to experience faster growth rates than the residential market in the coming years. This acceleration is attributed to two key factors: increasing awareness of fire safety in workplaces and the growing complexity of electrical systems in industrial settings. The cost of business interruption and downtime is a critical consideration in these environments, making the "selective tripping" and continuity of power offered by RCBOs a powerful value proposition.

In commercial buildings, RCBOs are used for lighting circuits, office equipment, and building management systems. In industrial settings, their applications are more demanding, including use with motors, transformers, and X-ray machines, which require devices capable of handling high inrush currents. The need for robust, reliable solutions that comply with evolving safety standards is fueling a shift towards more advanced and specific product types in these sectors.

The UK RCBO market is shifting from basic safety devices to smart, multifunctional protection systems. Growth is driven by regulatory mandates, IoT integration, and the rise of EV/renewables, with strongest momentum in commercial and industrial sectors.

Manufacturers must invest in R&D (RCBO/AFDD combos, smart IoT-enabled units), adapt to omnichannel distribution, and build installer trust through training and compliance support. Success will depend on offering reliable, future-ready solutions that combine safety, efficiency, and connectivity.

If you have any questions or require expert assistance with your electrical needs, our dedicated customer service team is ready to help. Give us a call or send us an email today and our dedicated team will provide you with the answers and support you need.

Learn More:

Why RCBOs Are a Must-Have in Modern Distribution Boards

Understanding the difference between MCB RCCB and RCBO

RCBO Market: Size, Trends, Growth Drivers & Forecast (2022-2033)

RCBO 6A–40A: B2B Use for Residential & Industrial Circuit Protection

RCD vs RCBO: Key Differences in Protection for Modern Distribution Systems

RCBO Safety Issues: Causes, Solutions, and Best Practices for Electrical Professionals

INQUIRY NOW