The global distribution boards market is characterized by a fragmented yet competitive landscape, with numerous providers ranging from large multinational corporations to specialized regional players. Key manufacturers are continually innovating to maintain and expand their market positions.

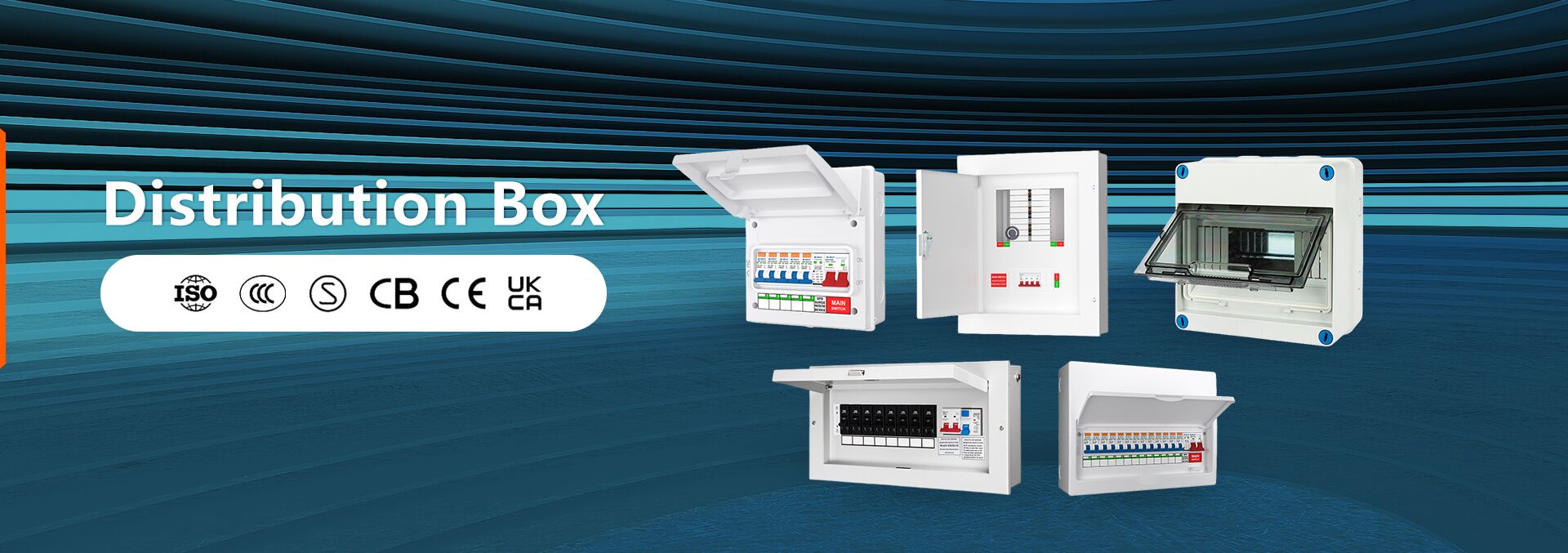

Laiwo Electrica (China): A Chinese manufacturer specializing in electrical distribution and protection equipment, Laiwo focuses on providing comprehensive low-voltage distribution solutions for residential, commercial, and industrial applications through their diverse product portfolio.

Strategy: Laiwo emphasizes delivering reliable and cost-effective electrical distribution systems with a focus on safety and compliance. They offer both metal and plastic enclosure solutions to meet various installation requirements, from residential consumer units to industrial distribution boards. The company positions itself as a comprehensive supplier for electrical contractors and installers seeking quality distribution equipment.

Representative Products: Metal consumer units, garage/EV consumer units, TPN distribution boards, plastic distribution boxes, plug-in type distribution boxes, miniature circuit breakers (MCBs), residual current circuit breakers (RCCBs), residual current breakers with overcurrent protection (RCBOs), and main switch disconnectors. Their product range covers the complete spectrum of low-voltage distribution and protection devices for modern electrical installations.

Learn More: Laiwo Distribution Board

ABB (Switzerland): A leading player in power and automation technologies, ABB's Electrification business segment provides comprehensive distribution automation solutions, accounting for a significant portion of its total revenue.

Strategy: ABB focuses on providing safe and reliable electrical distribution, offering pre-assembled systems for quick installation and efficient space utilization, particularly for outdoor installations. They emphasize intelligent solutions for energy efficiency, smart metering, and local/remote monitoring.

Representative Products: Modular substation packages, distribution automation products, switchgears, circuit breakers, control devices, solar power solutions, and EV charging infrastructure. ABB has introduced smart low voltage distribution panels with IoT-powered automated power management systems.

Learn More: ABB Distribution Board

Schneider Electric (France): A major player known for its energy management and automation solutions, holding a substantial market share.

Strategy: Schneider Electric focuses on smart and IoT-enabled panels for real-time monitoring and automation, enhancing safety features, and providing digital connectivity. They aim to improve energy management and reduce operational costs through their EcoStruxure Power platform.

Representative Products: EcoStruxure Power Distribution (low voltage panels), PowerPacT circuit breakers, ComPact NSX molded case circuit breakers, and FlexSet low-voltage switchboards.

Leran More: se distribution board

Siemens (Germany): A leading engineering solutions firm with a strong presence in automation, control, and power.

Strategy: Siemens concentrates on distribution automation solutions through its Smart Infrastructure segment, providing energy management systems, building products, low- and medium-voltage products, and digital grid solutions. They leverage digital tools and automation to lead in distribution boxes, with a focus on machine health monitoring and problem resolution.

Representative Products: WinCC/IndustrialDataBridge for data movement, Edge apps like SIMATIC Performance Insight, and various low- and medium-voltage products. Siemens has provided medium voltage distribution panels for large infrastructure projects.

Eaton (Ireland): A global power management company with extensive market reach.

Strategy: Eaton emphasizes comprehensive power management solutions, known for reliability and advanced safety features. They focus on strong supply chains, international operations, and continuous innovation, with a commitment to carbon neutrality by 2030.

Representative Products: A comprehensive range of power management solutions, including 3-phase distribution boards with real-time diagnostics and modular add-ons.

Legrand (France): A global specialist in electrical and digital building infrastructures.

Strategy: Legrand offers a broad range of end-to-end solutions for commercial, industrial, and residential applications, including smart home systems and innovative architectural lighting. They focus on strong, flexible, safe, and durable combination boxes.

Representative Products: Electrical wiring devices, critical power and infrastructure solutions (e.g., intelligent PDUs), lighting controls, lighting fixtures, network infrastructure, and wire & cable management. They introduced thermal imaging integrated panels in 2024.

Leran More: Legrand Distribution Board

Hager Group (Germany): A specialist in electrical installations for residential and commercial premises.

Strategy: Hager Group focuses on combining high-level energy performance with ease of installation and straightforward system expansion. They provide a comprehensive choice of products, emphasizing future-proofing through flexible, adaptable, and sustainable solutions.

Representative Products: Small enclosures, consumer units, distribution boards (e.g., quadro evo, invicta TPN), main incomers (ACBs, MCCBs), protection devices (MCBs, RCDs, RCBOs), energy management solutions, and EV charging stations.

Learn More: Hager Distribution Board

Chint Group (China): A leading smart energy solution provider.

Strategy: Chint focuses on high performance, reliability, and safety in electrical systems with modular designs for customization, advanced electrical fault protection, and robust enclosures. They emphasize smart monitoring capabilities and compliance with international standards.

Representative Products: Main Distribution Boards (EnergiX-M), Final Distribution Boxes, and various low voltage switchgear. Chint expanded its production facility in India in March 2024

Learn More: CHINT Distribution Board

Larsen & Toubro Limited (India): A major Indian multinational conglomerate with a significant presence in electrical and automation products.

Strategy: LTTS (L&T Technology Services) leverages extensive industry experience to deliver cutting-edge electrical power and controls solutions, focusing on efficiency, reliability, and sustainability. They provide tailored solutions that enhance operational efficiency while ensuring compliance with industry standards.

Representative Products: Transformers, current monitoring systems, static transfer switches, smart switches, switchgears, circuit breakers, surge protection devices, smart energy meters, and EV infrastructure solutions.

Learn More: LTTS Distribution Board

The intensity of market competition in the distribution boards sector can be analyzed through Porter's Five Forces framework:

Existing Rivalry (High): The market is fragmented with numerous players, from global giants to local manufacturers, leading to intense competition. Companies compete on product innovation (e.g., smart features, eco-friendliness), pricing, customization, and global presence. While large players dominate higher-value segments, the sheer number of competitors ensures a dynamic environment.

Threat of New Entrants (Medium-Low): While the market appears fragmented, the threat of significant new entrants is moderated by several factors. High capital investment is required for manufacturing facilities, R&D, and establishing extensive distribution networks. Additionally, stringent regulatory requirements and safety standards (e.g., UL, IEC certifications) create barriers to entry, as new players must invest heavily in compliance and testing. Established brand reputation and long-term relationships with B-side users (buyers, contractors, distributors) also pose a challenge for newcomers.

Threat of Substitutes (Low-Medium): Direct substitutes for distribution boards are limited, as they are fundamental components of any electrical system. While portable power distribution boxes exist, they serve temporary needs and are not direct substitutes for fixed installations. Innovations like decentralized power solutions or microgrids might reduce reliance on traditional central distribution boards in some niche applications, but these often still require some form of localized power management, maintaining the core function of a distribution board. The primary "substitute" would be alternative methods of power distribution within a building, which are generally less efficient or safe.

Bargaining Power of Suppliers (Medium): The bargaining power of suppliers for raw materials (e.g., metals, plastics, electronic components) can be medium. Fluctuating raw material prices directly affect manufacturing expenses and pricing strategies, creating instability. Supply chain disruptions can also impact production timelines and costs. However, large manufacturers often have diversified supply chains and long-term contracts, which can mitigate this power. For smaller players, supplier power might be higher.

Bargaining Power of Buyers (Medium-High): B-side users, including buyers, distributors, installers, and project contractors, possess significant bargaining power due to several factors. The fragmented market offers a wide array of choices, allowing buyers to compare products and negotiate prices. Buyers' increasing demand for customized, energy-efficient, and smart solutions also gives them leverage, pushing manufacturers to innovate and offer tailored products. Furthermore, the long-term nature of infrastructure projects means buyers seek reliable products and strong after-sales support, influencing supplier selection. However, for highly specialized or proprietary smart solutions, buyer power might be slightly reduced.

In summary, the market is characterized by intense internal competition among numerous players, but the fundamental need for distribution boards ensures a stable core demand. The challenges lie in navigating raw material volatility and technological advancements while meeting sophisticated buyer demands.

The global distribution boards market, while experiencing robust growth, faces several challenges that require strategic navigation. Simultaneously, numerous opportunities are emerging, driven by technological advancements and evolving global priorities.

Raw Material Price Volatility: A primary concern for manufacturers is the fluctuating cost of raw materials, such as metals (steel, aluminum, copper for busbars) and plastics. These variations directly affect manufacturing expenses and pricing strategies, creating instability in the market and potentially disrupting supply chains and profit margins. Managing these cost fluctuations is critical for maintaining profitability.

Supply Chain Disruptions: The global supply chain remains vulnerable to various disruptions, including geopolitical tensions, natural disasters, and unforeseen events. Such disruptions can impact the availability of components and raw materials, leading to increased lead times and production delays for distribution boards and related switchgear. This necessitates robust supply chain management and diversification strategies.

Technological Obsolescence: The rapid pace of technological advancements, particularly in smart home technology, IoT, and smart grid development, presents a significant challenge. Manufacturers must continuously innovate to integrate new features like real-time tracking, remote operation, and predictive maintenance, requiring substantial and often expensive investment in research and development. Failure to keep up can lead to products becoming outdated quickly, especially for conventional distribution boards. This challenge is compounded by the fact that the life expectancy of IT equipment (2-5 years) is much shorter than typical data center designs (10-15 years), leading to undersized power supply systems.

Regulatory Requirements and Compliance: Stringent governmental regulations and evolving compliance standards globally impose additional burdens on manufacturers. These regulations often necessitate costly adjustments in product design, manufacturing processes, and certifications (e.g., IEC, UL standards), impacting production timelines and market access. Adhering to diverse regional and national codes adds complexity and cost to product development and distribution.

Shortage of Skilled Labor: The electrical industry, including the installation and maintenance of complex distribution board systems, faces a shortage of skilled labor. This scarcity impacts the efficiency and quality of production processes, installation, and maintenance services, potentially leading to increased operational costs and project delays. The increasing complexity of electrical systems further necessitates specialized knowledge, which can deter potential customers and slow market adoption.

Adoption of Emerging Technologies: The increasing integration of IoT, AI, and smart grid technologies into distribution boards presents a significant opportunity. These advanced features enhance energy efficiency, enable real-time monitoring, and facilitate predictive maintenance, making them highly appealing across residential, commercial, and industrial sectors. The development of innovative software tools to aid in design and management further supports this trend.

Regional Market Expansion: Developing regions, particularly in Asia Pacific, Latin America, and the Middle East & Africa, offer substantial growth opportunities due to rapid industrialization, urbanization, and ongoing energy infrastructure development. These regions are experiencing surging electricity demand and significant investments in new construction and renewable energy initiatives, creating fertile ground for market expansion. North America also continues to present opportunities through grid innovation and data center expansion.

Growth in Niche Segments: Specific niche segments are experiencing accelerated growth. The burgeoning electric vehicle (EV) charging infrastructure market, for instance, drives demand for specialized EV consumer units and panelboards capable of handling high power outputs and integrating with renewable sources. Similarly, the expansion of data centers globally creates a continuous need for high-capacity, adaptable, and energy-efficient power distribution solutions

Policy Support and Renewable Energy Initiatives: Government policies and incentives promoting renewable energy adoption, energy efficiency, and smart grid development are creating a supportive environment for the distribution boards market. These initiatives not only drive demand for new installations but also encourage the upgrade and modernization of existing electrical infrastructure to accommodate green energy sources and improve grid resilience.

Modularization and Customization: The increasing demand for modular and customizable distribution boards allows manufacturers to cater to diverse and evolving industry needs, offering flexibility and scalability in commercial and industrial applications. This trend allows for tailored solutions that optimize performance for specific project requirements, enhancing customer satisfaction and market reach.

If you have any questions or require expert assistance with your electrical needs, our dedicated customer service team is ready to help. Give us a call or send us an email today and our dedicated team will provide you with the answers and support you need.

Raw Materials: UL/CE certified, conductivity/protection controlled.

Processing: Standardized precision manufacturing, full-process QC.

Inspection: 100% tested (voltage/insulation/temp rise), traceability reports.

Click here for Laiwo product certificates

INQUIRY NOW