Next: What is a fuse box?

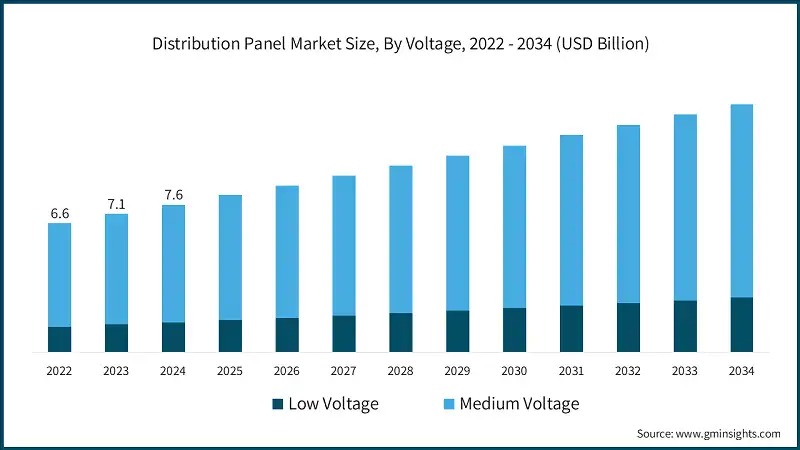

The global distribution boards market has demonstrated a consistent upward trajectory over the past three years. According to data from GMI, the global distribution panel market was valued at USD 6.6 billion in 2022, increasing to USD 7.1 billion in 2023, and reaching USD 7.6 billion in 2024. These figures indicate a steady and robust growth rate within this period.

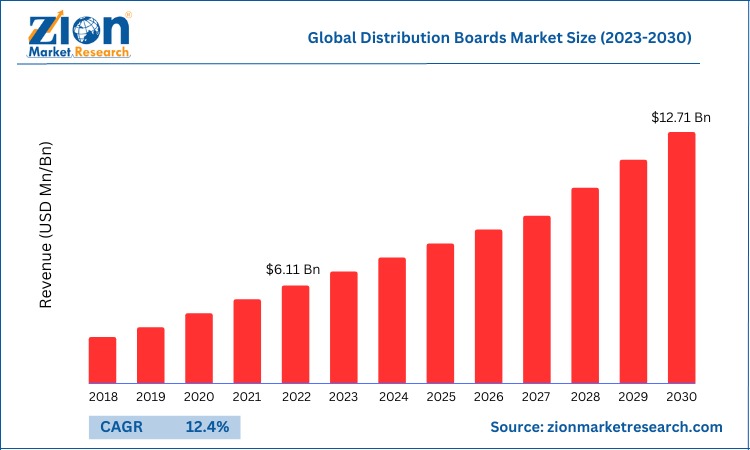

While other research sources present slightly varying numerical valuations, the overarching trend of market expansion remains consistent. For instance, Zion Market Research reported the global distribution boards market size at USD 6.11 Billion in 2022. MarketResearchFuture indicated the market size was USD 4.78 Billion in 2023 and projected it to be USD 5.09 Billion in 2024. Similarly, GrandViewResearch estimated the market at USD 4.72 billion in 2023 and USD 5.01 billion in 2024. These differences in valuation methodologies across various reports are common, but the underlying narrative of growth is universally supported.

The consistent growth observed across all sources is broadly attributed to several fundamental factors. These include:

accelerating urbanization, leading to increased construction infrastructure development;

widespread electrification programs in developing regions;

ongoing industrialization trends necessitating robust power distribution networks;

increasing emphasis on safety and stringent regulatory compliance in electrical installations;

evolving global energy consumption patterns driven by technological advancements and rising demand across sectors;

These macro-economic and societal shifts collectively underpin the sustained expansion of the distribution boards market.

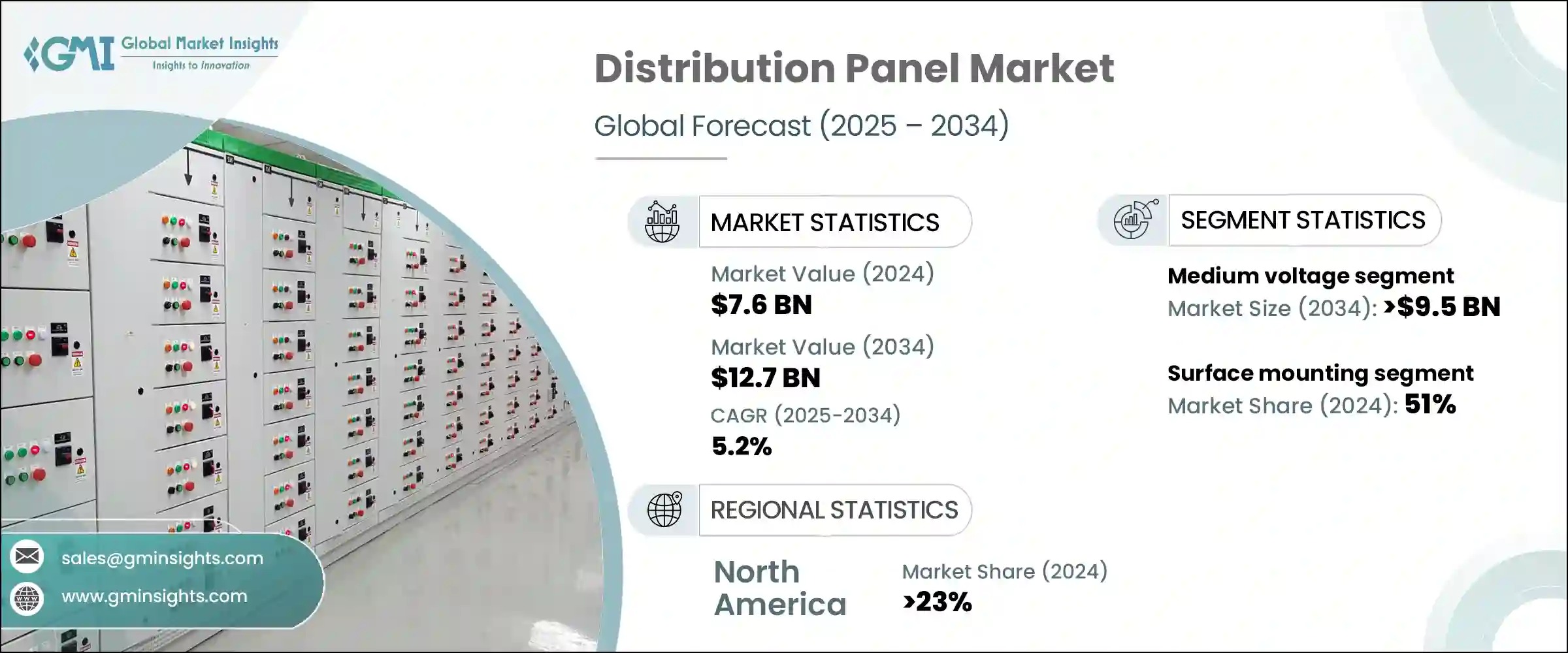

Looking ahead, the global distribution boards market is projected to continue its upward trajectory, driven by persistent demand and evolving technological landscapes. GMI estimates the global distribution panel market to reach a value of USD 12.7 billion by 2034, growing at a Compound Annual Growth Rate (CAGR) of 5.2% from 2025 to 2034. This long-term forecast suggests sustained expansion.

More specifically for the requested period, Research and Markets, along with The Business Research Company, provide a focused projection. They anticipate the distribution board market to escalate from $6.96 billion in 2024 to $7.48 billion in 2025, exhibiting a CAGR of 7.4%. The market is then projected to expand further to $10.58 billion in 2029, with an accelerating CAGR of 9.1%. This indicates a strong and potentially increasing growth rate within the next five years.

Distribution boards are indispensable across a wide range of application areas, each presenting unique demands and growth drivers. Understanding these sector-specific requirements is crucial for B-side users to optimize procurement and distribution strategies.

The industrial sector represents a significant application area for distribution boards, driven by ongoing industrialization, factory automation, and the need for robust, reliable power distribution.

The global industrial distribution panel market was estimated at USD 1.2 billion in 2024 and is projected to reach USD 2 billion by 2034, growing at a CAGR of 4.5% from 2025 to 2034. This growth is fueled by rising investments in manufacturing, infrastructure, and energy sectors, alongside the increasing adoption of automation control systems and smart energy management technology. The expansion and upgrading of production plants necessitate advanced power distribution networks, leading to a rising demand for distribution boards. The medium voltage segment, crucial for industrial applications, dominates this market.

The commercial sector, encompassing office buildings, retail spaces, hotels, and shopping centers, is a substantial consumer of distribution boards due to continuous construction and modernization activities.

The commercial distribution panel industry was valued at USD 2.8 billion in 2024, with the medium voltage segment expected to cross USD 4.5 billion by 2034. This growth is driven by the urbanization of different regions, improving infrastructures, and the need for reliable electricity distribution in new commercial buildings and data centers. The rising demand for energy-saving IoT panels and smart building technologies also contributes significantly to market expansion.

The residential segment emerged as the dominant force in the distribution boards market in 2024, securing a market share of 45%, driven by the surge in urbanization and housing projects. The demand for low voltage distribution boards is particularly strong here, catering to the widespread need for safe and efficient electrical distribution. The adoption of energy-intensive technologies, such as electric heating systems and EV charging stations, in modern homes also increases demand.

Source: Distribution Boards Market Size, Growth, Trends and Forecast

The energy and utilities sector relies heavily on distribution boards for managing the vast and complex electrical grid infrastructure, from power generation to final delivery.

The utilities end-user segment accounted for the highest revenue market share of over 41.0% in 2023 and is expected to grow at a faster CAGR of 5.7% during the forecast period. This dominance is sustained by ongoing investments in grid infrastructure upgrades, smart grid initiatives, and the adoption of advanced distribution board solutions.The increasing need for protecting electrical components and networks, coupled with investments in renewable energy production units, drives demand.

Data centers are critical infrastructure demanding exceptionally reliable, high-capacity, and energy-efficient power distribution solutions, making them a rapidly growing application area for distribution boards.

Global demand for computing power is surging, leading to massive capital deployment in data centers, projected at $1.8 trillion from 2024 to 2030. This expansion fuels significant demand for dependable, high-capacity power distribution solutions, including distribution boards. The continuous need for increased energy efficiency and adaptability in IT environments also drives market demand.

Source: Breaking Barriers to Data Center Growth

For buyers, distributors, installers, maintenance service providers, and project contractors operating within the global distribution boards market, strategic planning is essential to capitalize on opportunities and mitigate challenges. The following recommendations are tailored to optimize operations and foster sustainable growth from a B-side user perspective.

Procuring distribution boards requires a nuanced approach that balances cost, quality, and long-term value.

Supplier Selection:

Prioritize suppliers with a proven track record of reliability, adherence to international quality and safety standards (e.g., CE/UKCA, IEC, UL certifications), and robust after-sales support.

Evaluate a supplier's R&D capabilities, especially for smart and energy-efficient solutions, as this indicates their capacity for future-proofing.

Consider suppliers with strong global footprints and diversified supply chains to mitigate risks associated with raw material volatility and supply chain disruptions

Learn More:

Cost Control:

While initial cost is a factor, focus on the total cost of ownership (TCO). This includes installation ease (e.g., modular designs, pre-assembled units), energy efficiency (reducing operational costs), and maintenance requirements. Negotiate long-term contracts with preferred suppliers to secure stable pricing and ensure consistent supply, especially for high-volume projects.

Quality Standards and Compliance:

Mandate adherence to relevant local electrical codes and international standards.

Ensure products are certified by reputable bodies (e.g., UL, CE) to guarantee safety, performance, and regulatory compliance.

Request documentation and test reports to verify product specifications and performance.

Customization Needs:

Clearly define project-specific requirements, including voltage rating, load capacity, environmental conditions (indoor/outdoor, IP/NEMA ratings), and integration with smart systems.

Work closely with manufacturers offering modular and customizable solutions to ensure the distribution boards perfectly match the application, optimizing efficiency and preventing costly modifications later

Long-Term Partnership Recommendations:

Foster strategic, long-term relationships with key manufacturers and distributors. This can lead to benefits such as preferential pricing, priority access to new technologies, dedicated technical support, and collaborative development of tailored solutions for future projects.

Engaging with suppliers who invest in talent development and offer training can also be beneficial for internal team capabilities.

Contact us today, as an ISO-certified factory with over 20 years of ODM/OEM expertise, we're ready to help. We provide comprehensive distribution systems designed to meet your power needs across diverse scenarios.

Distributors play a pivotal role in connecting manufacturers with end-users. Optimizing distribution networks and service quality is key to market share expansion.

Optimize Distribution Networks:

Strategically expand warehouse and logistics capabilities to ensure efficient delivery and reduce lead times, particularly in rapidly growing regions like Asia Pacific.

Leverage digital platforms for inventory management, order processing, and customer relationship management to enhance operational efficiency.

Enhance Service Quality:

Provide comprehensive pre-sales and post-sales support, including technical consultation, product selection guidance, and rapid response to inquiries.

Offer value-added services such as customization, pre-assembly, and on-site support to differentiate from competitors.

Expand Market Share:

Focus on both high-volume, lower-margin standard products and specialized, higher-margin intelligent distribution boards to cater to diverse customer needs.

Develop expertise in emerging technologies like smart grid integration and EV charging solutions to tap into high-growth niche segments. Collaborate with manufacturers on marketing initiatives and product launches to increase visibility and market penetration.

Contact us today! LAIWO specializes in a wide range of products, including:

TP&N Metal Distribution Boards

Plug In Type Distribution Boxes

We also provide essential circuit protection devices like MCBs, RCCBs, RCBOs, and Surge Protectors. Let's discuss your project needs!

Installers and maintenance service providers are on the front lines, ensuring the safe and efficient operation of electrical systems. Their expertise and service quality are paramount.

Technical Training and Skill Development:

Invest continuously in technical training for staff, covering the latest advancements in distribution board technology, including smart features, IoT integration, and renewable energy systems.

Ensure proficiency in installation, troubleshooting, and maintenance of both traditional and advanced systems, adhering to all safety protocols and regulatory requirements.

Address the industry-wide shortage of skilled labor by developing internal training programs or partnering with educational institutions.

Service Innovation:

Develop and offer innovative service packages that go beyond basic installation and repair. This could include predictive maintenance contracts utilizing smart board diagnostics, energy efficiency audits, system upgrades for smart home or industrial automation integration, and specialized services for EV charging infrastructure. Emphasize the long-term benefits of proper maintenance in terms of safety, efficiency, and equipment longevity.

Customer Relationship Management:

Build strong, long-term relationships with clients by offering reliable, high-quality service and proactive communication.

Provide clear explanations of work performed, maintenance schedules, and potential upgrade recommendations.

Educate clients on the benefits of smart technologies and energy-efficient solutions to drive adoption and foster trust.

Business Expansion:

Explore opportunities to expand service offerings into new application areas, such as data centers or large-scale renewable energy projects, which often require specialized expertise.

Consider partnerships with manufacturers or larger contractors to undertake more complex projects and leverage their resources and brand recognition.

Focus on providing solutions that enhance safety, reliability, and energy efficiency, aligning with evolving market demands.

Become our partner and find opportunities to expand your market!

The global distribution boards market is propelled by a confluence of macroeconomic factors and technological advancements. These drivers and emerging trends are shaping the demand, design, and functionality of distribution boards across various sectors.

Urbanization and Industrialization:

Rapid urbanization and sustained industrialization, particularly in developing regions, are fundamental drivers of market growth. As populations migrate to urban centers, the demand for new residential, commercial, and industrial infrastructure surges. Each new building or upgraded facility requires robust electrical distribution systems, with distribution boards at their core, to manage and allocate power efficiently and safely. This expansion directly translates into increased demand for distribution boards.

Infrastructure Development:

Significant investments in infrastructure development globally, including smart city projects, transportation networks, and public utilities, are fueling the demand for advanced power distribution solutions. Modern infrastructure necessitates reliable, high-capacity electrical networks, where distribution boards play a critical role in ensuring stable power supply and protection. For instance, grid innovation initiatives and an enhanced focus on the construction sector in North America are primary growth drivers.

Energy Transition and Renewable Energy Integration:

The global shift towards renewable energy sources such as solar and wind power is creating substantial opportunities for the distribution boxes market. These intermittent energy sources require specialized distribution boards capable of managing variable frequency outputs and high voltages, ensuring seamless integration into existing grids or standalone systems. The increasing allocation of funds to renewable energy production units directly boosts demand for tailored distribution board solutions.

Smart Grid Development:

The modernization of power grids into "smart grids" is a significant driver. Smart grids leverage digital technologies to enhance visibility and control over grid assets, promoting efficiencies, reducing operating costs, and enabling the integration of large-scale renewables and customer-owned distributed energy resources (DERs). Distribution boards are integral to this transformation, acting as critical points for real-time monitoring, remote operation, and predictive maintenance functionalities, which are essential for smart grid efficiency and reliability.

Increasing Need for Electrical Protection:

A fundamental and enduring driver is the growing recognition by businesses and governments of the critical need to safeguard electrical components and networks. Distribution boards, with their integrated circuit breakers and surge protector, are the primary means of protecting against overloads and short circuits, preventing damage to equipment, and enhancing overall safety. This imperative for safety and reliability continues to underpin market expansion.

Digitalization and Smart Infrastructure:

The market is witnessing a profound shift towards digitalization, driven by the integration of Internet of Things (IoT) technologies and Artificial Intelligence (AI). Smart distribution boards offer features like real-time tracking, remote monitoring and control, and predictive maintenance, making them highly appealing for residential, commercial, and industrial uses. This trend enhances energy efficiency, reduces operational costs, and improves system resilience by anticipating failures before they occur. The development of innovative software tools also aids engineers in designing and verifying circuit schematic designs for these advanced boards.

Modularization and Compact Designs:

There is a growing demand for modular and compact distribution boards, driven by the need for flexibility, scalability, and space optimization, particularly in urban infrastructure and data centers. Modular designs facilitate easier installation, maintenance, and future upgrades, catering to diverse industry needs and allowing for customized configurations. This trend is particularly relevant for installers and project contractors seeking adaptable solutions.

Eco-friendliness and Sustainability:

With increasing energy prices and a global emphasis on sustainability, consumers and businesses are seeking more efficient and environmentally friendly products. This trend drives manufacturers to invest in research and development for eco-friendly distribution boards, including those made from recyclable materials or designed for optimal energy utilization.

Customization Demands:

The diverse and evolving requirements across various application areas—from residential smart homes to complex industrial plants—are driving a strong demand for customizable distribution boards. Manufacturers are increasing their production capacities to offer tailored solutions that meet specific electrical load requirements, safety standards, and operational conditions. This focus on customization allows for optimized performance and compliance in specialized applications.

If you have any questions or require expert assistance with your electrical needs, our dedicated customer service team is ready to help. Give us a call or send us an email today and our dedicated team will provide you with the answers and support you need.

Raw Materials: UL/CE certified, conductivity/protection controlled.

Processing: Standardized precision manufacturing, full-process QC.

Inspection: 100% tested (voltage/insulation/temp rise), traceability reports.

Click here for Laiwo product certificates

Source:

What's the purpose of an electrical distribution board? - Rubber Box

Understanding the Functionality of Electrical Distribution Box Systems

Distribution board - Wikipedia

Distribution Boards Market Size, Share, Growth | Report 2032

Distribution Board Market Report 2025 - Research and Markets

Distribution Board Market Size Forecasted To Achieve $10.58 - openPR.com

Distribution Board Market Size, Share, Growth and Outlook 2030

Your Definitive Guide to TP&N Distribution Boards - LAIWO Electrical Technology

Three Phase Distribution - A Complete Guide - Fusebox Shop

Fixed Mounting Power Distribution Component Market Size and Outlook 2030 - TechSci Research

3-Phase Distribution Boards Market Size & Share [2033]

North America Distribution Panel Market Size & Share, Forecast 2032

EV Charging Panelboard Market Size, Share and Forecast 2032 - Credence Research

Electric Vehicle Charging Infrastructure Market Report, 2030 - Grand View Research

Smart Distribution Board Market Size, Share, Industry Trends

Complete Guide to Commercial Distribution Panels [May 2025] - E-Abel

Commercial Distribution Panel Market Size, Report 2034

INQUIRY NOW